Conserve Some Money With Your Home Mortgage!

Content author-Hart HoffmanGetting a home mortgage can sometimes be very difficult. If you are looking for your dream home and in search of a mortgage, then you will want good information about what to look for. Continue to the article below for many tips on how to go about choosing the right home mortgage.

Consider unexpected expenses when you decide on the monthly mortgage payment that you can afford. It is not always a good idea to borrow the maximum that the lender will allow if your payment will stretch your budget to the limit and unexpected bills would leave you unable to make your payment.

Avoid borrowing your maximum amount. A mortgage lender will show you how much you are qualified for, however, these figures are representative of their own internal model, not exactly on how much you can afford to pay back. You need to consider how much you pay for other expenses to determine how comfortably you can live with your mortgage payment.

Your loan can be denied by any changes in your financial situation. Avoid applying for mortgages without a secure job. Never change jobs after you have applied for a mortgage.

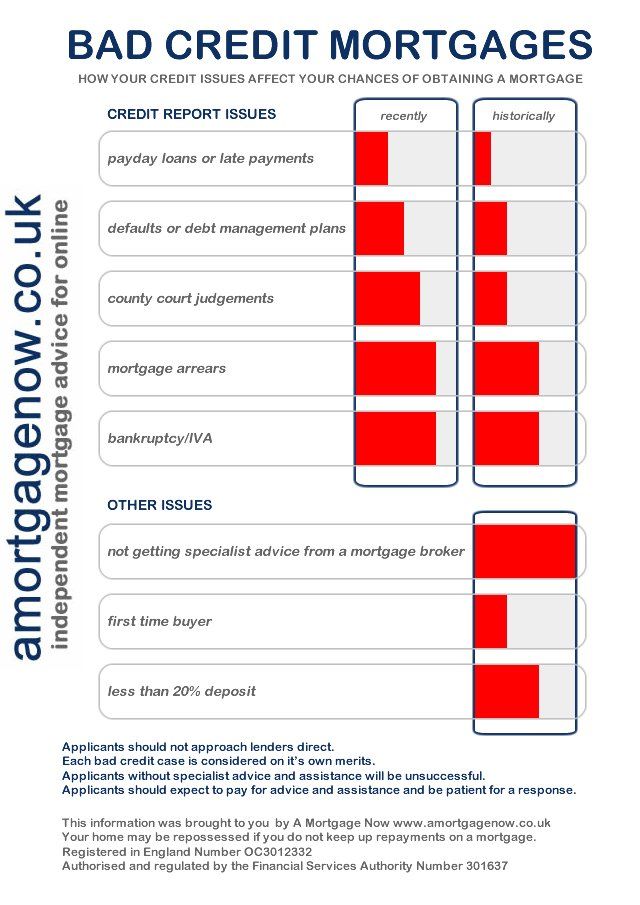

If you're thinking of getting a mortgage you need to know that you have great credit. Lenders review credit histories carefully to make certain you are a wise risk. Do what you need to to repair your credit to make sure your application is approved.

You may be able to add your homeowners insurance costs to your mortgage payment. One advantage of this is negating the need to make two payments. Instead of paying your mortgage and an insurance bill, you can pay both bills in one payment. If you like to consolidate your bills, this is a good idea.

Try getting pre-approved for a mortgage before you start looking at houses. This will make the closing process a lot easier and you will have an advantage over other buyers who still have to go through the mortgage application process. Besides, being pre-approved will give you an idea of what kind of home you can afford.

Make sure you've got all of your paperwork in order before visiting your mortgage lender's office for your appointment. While logic would indicate that all you really need is proof of identification and income, they actually want to see everything pertaining to your finances going back for some time. Each lender is different, so ask in advance and be well prepared.

Draw up a budget before applying for a home loan. It is important that you know how much you can realistically spend on a mortgage payment. If you aren't paying attention to your finances, it is easy to over-estimate how much you can afford to spend. Write down your income and expenses before applying for the mortgage.

If you have bad credit, avoid applying for a home mortgage. Although you may feel financially ready enough to handle the costs of a mortgage, you will not qualify for a good interest rate. This means you will end up paying a lot more over the life of your loan.

Chose a bank to carry your mortgage. Not all companies who finance homes are banks. Some of them are investment companies and private corporations. Though you may be comfortable with them, banks are usually the easier option. https://sanatogapost.com/2021/12/15/citadel-names-sutliff-business-head/ can usually cut down the turn-around time between application and available funds.

Knowledge is power. Watch home improvement shows, read homeowner nightmare types of news stories, and read books about fixing problems in houses. Arming yourself with knowledge can help you avoid signing a mortgage agreement for a house needing expensive repairs or an unexpected alligator removal. Knowing what you are getting into helps you avoid problems later.

Most financial institutions require that the property taxes and insurance payments be escrowed. This means the extra amount is added onto your monthly mortgage payment and the payments are made by the institution when they are due. This is convenient, but you also give up any interest you could have collected on the money during the year.

Look into foreclosed homes before you seek out properties that are brand new. Banks don't mind dealing with other banks, and they certainly prefer less expensive properties. If you can find a home that's offered for a great price, especially if the bank in question owns it, they will jump at the opportunity to have someone pick up the tab. It's a better option for them than auctions.

Consider a home mortgage plan that incorporates the property taxes into this. Some companies will even give you a break on interest if you do this, as in makes it more likely that you will keep possession of your home. Not paying your taxes could lead to someone else owning the property on which your home resides.

Talk to the BBB before making your final decision. Deceitful brokers may con you into paying high fees and refinancing so that they can make more money. If a broker wants you to pay excessive points or high fees, be cautious.

You can save money on a mortgage by going with a lender who offers to finance with no closing costs. Closing costs are a significant part of a mortgage. To make up for that lost money, however, the lenders will make up it in some other way. Usually with a slightly higher interest rate.

How flexible is the payment schedule being offered to you? With greater flexibility comes the ability to pay off your mortgage more quickly, but it may also include higher interest rates. Consider how much you will spend over the entire life of the mortgage as you compare your options.

Use what you learned here to get the right mortgage for you. With a little effort, you can find out a lot about the mortgage process. You don't have to feel frustrated with the options that are out there. Rather, let the knowledge be your road map to mortgage success.